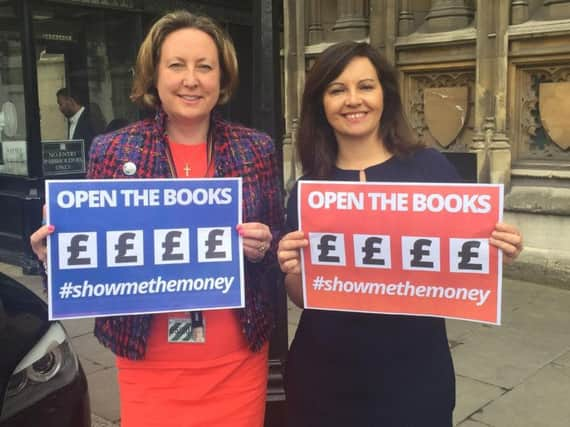

Berwick MP wants multinationals to 'show me the money'

Twelve members of the Public Accounts Committee, along with two former chairmen, have added their names to the amendment introduced by Caroline Flint MP, nicknamed the #showmethemoney amendment.

If passed, it will require large, multinational companies to publish information about where they make money and pay taxes. MPs will have the opportunity to vote on this measure on Tuesday, June 28, when the Finance Bill is debated in the House of Commons.

Advertisement

Hide AdAdvertisement

Hide AdMrs Trevelyan said: "In February, the Public Accounts Committee, on which I sit, heard evidence from both HMRC and Google about their now-infamous £130million tax deal. Regardless of the questions we asked or how we probed the witnesses, due to the extreme secrecy and confidentiality that surrounds these settlements, we could not say whether this was a good deal for the taxpayer. We are now convinced that the best way to tackle this issue is through greater transparency.

“We believe the tide of opinion is moving towards openness, after the Google tax affair and the release of the Panama Papers. We want successful companies in the UK, but we want them to pay tax fairly.

"Too many multinational companies seem to be choosing the tax they want to pay, rather than paying the tax they should pay, via complicated international arrangements. We cannot have one rule for UK businesses that pay their fair share and another for multinationals able to shift their profits around the globe. Our message to the Chancellor and the Government is – take a lead and back our amendment.”

This cross-party initiative has the backing of MPs from nine different parties. The campaign is also supported by Tax Justice Network, Global Witness, business-led Fair Tax Mark and key groups from the development lobby, including Oxfam, Christian Aid, Action Aid, Save the Children and CAFOD. Charities say that developing countries lose more in taxes unpaid by big business every year than they receive in aid.